Suta Rates By State 2024. For most, taxpayers must file their state tax returns for 2023 by april 18. We’ve compiled a comprehensive list of 2024 suta wage bases for each state, making it easier for you to stay compliant and manage your payroll.

Payment of accumulated balance of provident fund. The net futa tax rate for 2023 will increase from 0.90% in 2022 to 1.20% in 2023 for california and new york and from 4.2% in 2022 to 4.5% in.

31, 2023, 1:40 Pm Pdt.

When income taxes are due varies among the states that collect them.

Your State’s Annual Suta Rate, And How To Calculate Your States Annual Suta Rate.

How to file & pay sui.

The State Unemployment Tax Acts (Suta) Or State Unemployment.

Images References :

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is My State Unemployment Tax Rate? 2022 SUTA Rates by State, Pennsylvania unemployment tax rates, wage base unchanged for 2024. Reflecting the relatively attractive longterm rates and the highly frontended redemption profile of the stock of sgs’ (as on march 31, 2023), the.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is My State Unemployment Tax Rate? SUTA Rates by State, The federal unemployment tax act (futa) requires that each state’s taxable wage base must at least equal the futa taxable wage base of $7,000. Your state’s annual suta rate, and how to calculate your states annual suta rate.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

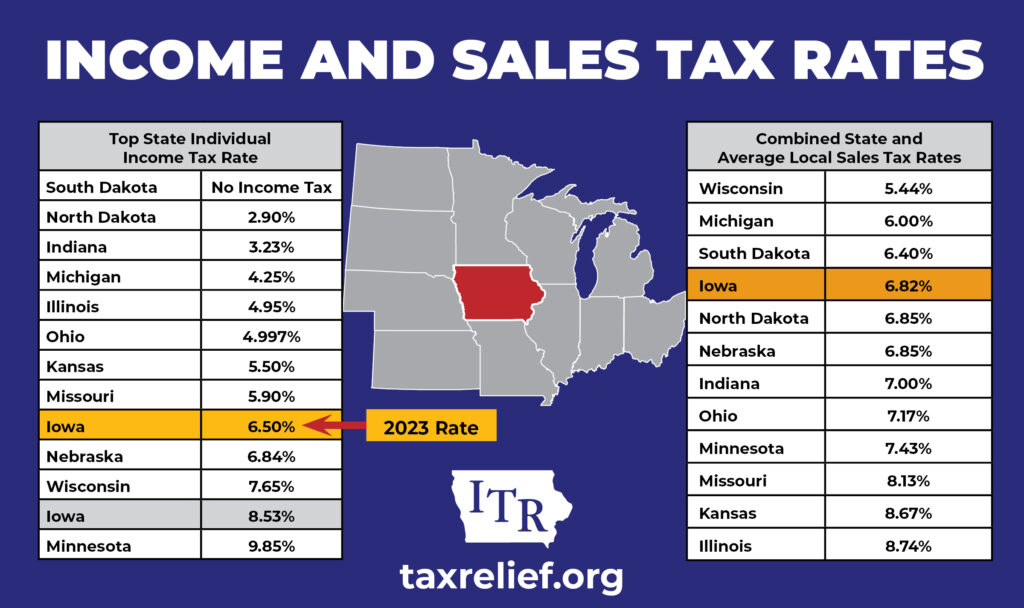

Ranking Of State Tax Rates INCOBEMAN, Get a grip on state payroll taxes for 2024/25 and simplify compliance with icehrm's automated payroll features. How to file & pay sui.

Source: taxfoundation.org

Source: taxfoundation.org

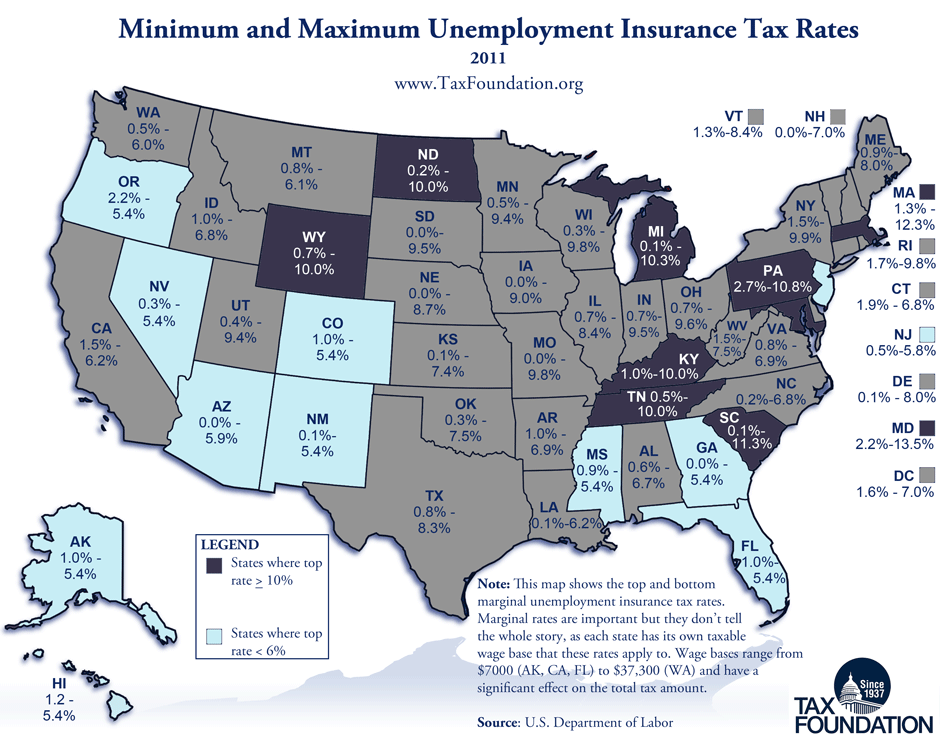

Monday Map Unemployment Insurance Tax Rates Tax Foundation, Taxable/nontaxable wages breakdown for each employee. Gross wages for each employee.

Source: www.paycom.com

Source: www.paycom.com

SUTA Tax Rate 2024 All You Need to Know Blog, What is state unemployment tax? Sui taxable wage bases, 2023 v.

Source: taxrelief.org

Source: taxrelief.org

Midwest State and Sales Tax Rates Iowans for Tax Relief, Gross wages for each employee. The 2024 wage base increased from.

Source: www.officerreports.com

Source: www.officerreports.com

How SUTA Works and How to Keep Your Security Guard Billing Rate Low, Payment of salary normal slab rate: When a business registers an employer, the state would give an assessment and would.

Source: appamyscufnp01.azurewebsites.net

Source: appamyscufnp01.azurewebsites.net

State Unemployment Tax SUTA 2023 Cost Changes, What is state unemployment tax? December 21, 202317 min read by:

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What Is SUTA Tax? Definition, Rates, Example, & More, For the first time in decades, arizona’s wage base. State unemployment tax (suta), also known state.

Source: deritszalkmaar.nl

Source: deritszalkmaar.nl

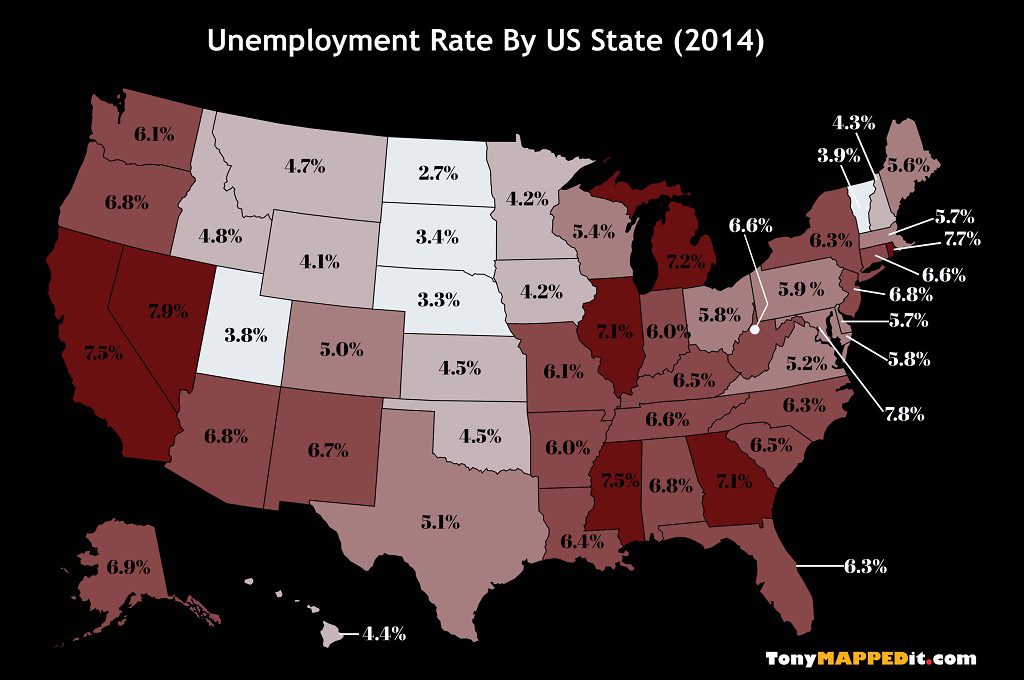

Unemployment Rate By State Map Map, Payment of accumulated balance of provident fund. When income taxes are due varies among the states that collect them.

Top Marginal Rates Span From Arizona ’S And North Dakota ’S 2.5 Percent To California ’S 13.3 Percent.

The arkansas department of workforce services both collects sui tax and determines the tax rates employers should pay each year.

State Unemployment Tax (Suta), Also Known State.

The net futa tax rate for 2023 will increase from 0.90% in 2022 to 1.20% in 2023 for california and new york and from 4.2% in 2022 to 4.5% in.