2024 Roth Contribution Limits 2024 Single. For 2024, the total contributions you can make to any ira (traditional or roth) can’t be more than the following limits: For the tax year 2024, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older.

For 2023, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2023). For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

The Roth Ira Contribution Limit Increases From $6,500 In 2023 To $7,000 In 2024.

For the tax year 2024, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older.

New Roth Ira Rollover Rules.

For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

An Investor Is Not Eligible To Make A Contribution If Their Magi Is $161,000 Or.

Images References :

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, 2024 roth ira contribution limits and income limits. You could contribute up to $90,000 in a single year, or $180,000 for a married couple.

Source: gwynethwbev.pages.dev

Source: gwynethwbev.pages.dev

Limits For 401k 2024 Tobye Leticia, For 2023, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2023). An investor is not eligible to make a contribution if their magi is $161,000 or.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, For 2023, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2023). 2024 roth ira contribution limits and income limits.

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. If you make over a certain amount, this limit might be lowered or you.

Source: www.carboncollective.co

Source: www.carboncollective.co

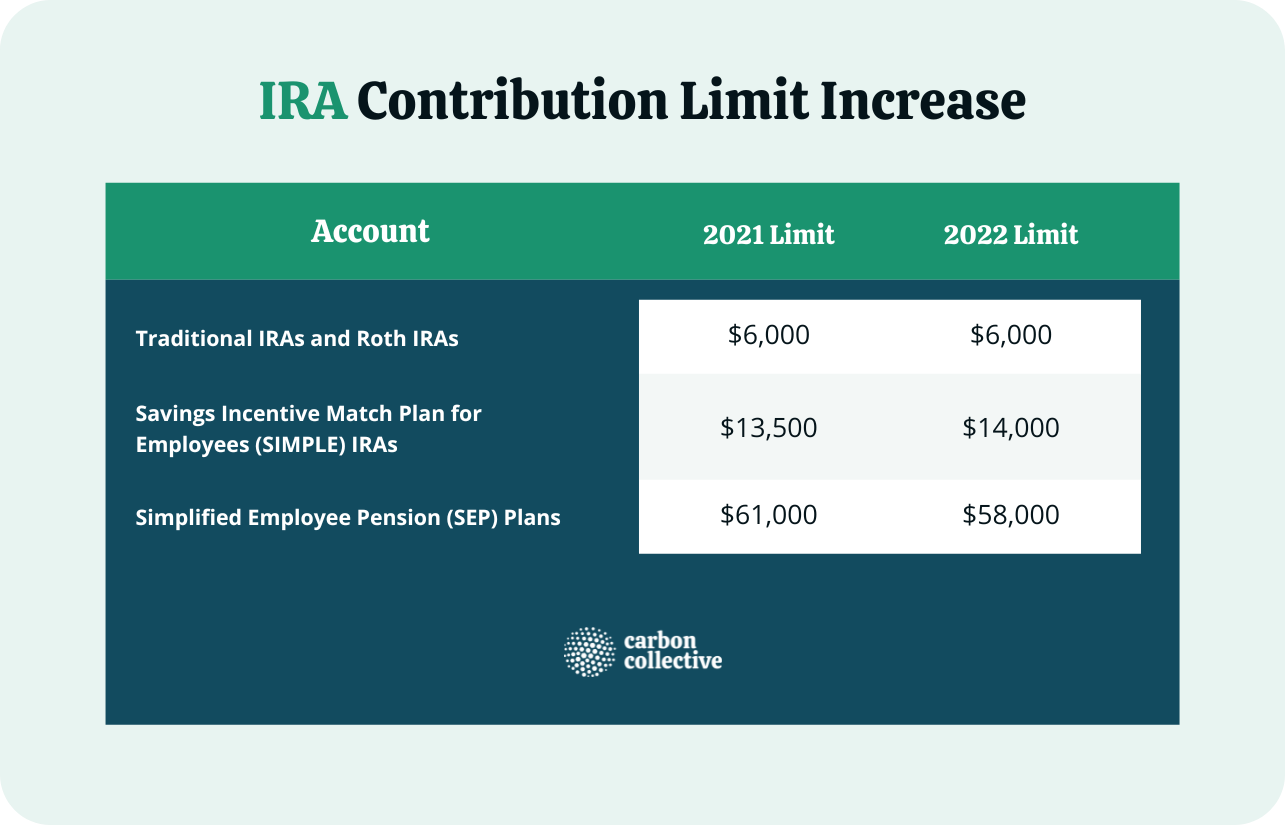

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, New roth ira rollover rules. In 2024 you can contribute up to $7,000 or.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), In 2024, single filers making less than $161,000 and those married filing jointly making less than $204,000 are eligible. Roth ira accounts are subject to income limits.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS announced its Roth IRA limits for 2022 Personal, The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. In 2024, you can contribute a maximum of $7,000 to a roth ira.

Source: vnexplorer.net

Source: vnexplorer.net

Roth IRA Contribution Limits for 2024, New roth ira rollover rules. In 2024, single filers making less than $161,000 and those married filing jointly making less than $204,000 are eligible.

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2023 and 2024 Skloff Financial, 2024 roth ira contribution limits. For the tax year 2024, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older.

Source: thestockmarketnews.com

Source: thestockmarketnews.com

Calculating Roth IRA 2023 and 2024 Contribution Limits The Stock, An investor is not eligible to make a contribution if their magi is $161,000 or. For 2024, the total contributions you can make to any ira (traditional or roth) can’t be more than the following limits:

The Contribution Limit Shown Within Parentheses Is Relevant To Individuals Age 50 And Older.

The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023.

For 2024, The Total Contributions You Can Make To Any Ira (Traditional Or Roth) Can’t Be More Than The Following Limits:

The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500 or $7,500 if you were age 50 or older.